what is the tax rate in tulsa ok

The County sales tax rate is. Tax rate of 475 on taxable income over 12200.

Oklahoma Sales Tax Small Business Guide Truic

74101 74102 74103.

. There is no applicable special tax. Tulsa County collects on average 106 of a propertys assessed fair market value as property tax. A county-wide sales tax rate of 0367 is applicable to localities in Tulsa County in addition to the 45 Oklahoma sales tax.

Earn what you deserve. The average family pays 163300 in Oklahoma income taxes. Tulsa is in the following zip codes.

A permanent resident One who occupies or has the right to occupy any room or rooms in the hotel for at least 30 consecutive days. Select the Oklahoma city from the list of popular cities below to see its current sales tax rate. The average yearly property tax paid by Tulsa County residents amounts to about 216 of their yearly income.

Real property tax on median home. The December 2020 total local sales tax rate was also 8517. The tax must be paid on the occupancy or the right of occupancy of room s in a hotel.

That puts Oklahomas top income tax rate in the bottom half of all states. About our Cost of. For the 2021 tax year Oklahomas top income tax rate is 5.

The City of Tulsa imposes a lodging tax of 5 percent. The Oklahoma state sales tax rate is currently. With six marginal tax brackets based upon taxable income payroll taxes in Oklahoma are progressive.

Who and How Determines Tulsa County Property Tax Rates. Other executive directors track. Tulsa County Sales Tax Rates for 2022.

The average total salary of Executive Directors in Tulsa OK is 90500year based on 18 tax returns from TurboTax customers who reported their occupation as executive directors in Tulsa OK. You can find more tax rates and allowances for Tulsa and Oklahoma in the 2022 Oklahoma Tax Tables. Did South Dakota v.

The Tulsa sales tax rate is. 18 full-time salaries from 2019. Tax rate of 275 on taxable income between 7501 and 9800.

The state sales tax rate in Oklahoma is 4500. For the Single Married Filing Jointly Married Filing Separately and Head of Household filing statuses the OK tax rates and the number of tax brackets remain the same. Tax rate of 375 on taxable income between 9801 and 12200.

2021 Tulsa County Tax Rates County of Tulsa 2021 Levies Detail 2020-2021 Tax Distribution. Tax rates sometimes referred to as millage rates are set by the Excise Board. Inside the City limits of Tulsa the Sales tax and Use tax is 8517 which is allocated between three taxing jurisdictions.

As far as all cities towns and locations go the place with the highest sales tax rate is Glenpool and the place with the lowest sales tax rate is Leonard. The most populous location in Tulsa County Oklahoma is Tulsa. You can print a 8517 sales tax table here.

The minimum combined 2022 sales tax rate for Tulsa Oklahoma is. Situated along the Arkansas River in northeast Oklahoma Tulsa County has the second highest property tax rates in the state. With local taxes the total sales tax rate is between 4500 and 11500.

Single filers will pay the top rate after earning 7200 in taxable income per year. The 2018 United States Supreme Court decision in South Dakota v. Taxes in Tulsa Oklahoma are 26 cheaper than Branson Missouri.

Effective Tax Rates for Executive Directors in Tulsa OK. Oklahoma Income Tax Table Learn how marginal tax brackets work 2. Lower sales tax than 69 of Oklahoma localities 2483 lower than the maximum sales tax in OK The 8517 sales tax rate in Tulsa consists of 45 Oklahoma state sales tax 0367 Tulsa County sales tax and 365 Tulsa tax.

Tulsa in Oklahoma has a tax rate of 852 for 2022 this includes the Oklahoma Sales Tax Rate of 45 and Local Sales Tax Rates in Tulsa totaling 402. Sales Tax State Local Sales Tax on Food. Oklahoma residents are subject to Oklahoma excise tax on vehicles purchased in another state.

Above 100 means more expensive. Below 100 means cheaper than the US average. State of Oklahoma 45 Tulsa County 0367 City 365 What is the tax rate in Tulsa County.

Your 2021 Tax Bracket to See Whats Been Adjusted. Who is exempt from the tax. Some cities and local governments in Tulsa County collect additional local sales taxes which can be as high as 5766.

The Tulsa County sales tax rate is. The 2018 United States Supreme Court decision in South Dakota v. This is the total of state and county sales tax rates.

The average cumulative sales tax rate between all of them is 828. The Oklahoma sales tax rate is currently. Open Monday- Friday 830 am - 500 pm.

How Does Sales Tax in Tulsa compare to the rest of Oklahoma. Oklahoma has recent rate changes Thu Jul 01 2021. That assigned value is taken times the established tax rate the sum of all applicable governmental taxing-delegated units levies.

The Tulsa County Sales Tax is 0367 A county-wide sales tax rate of 0367 is applicable to localities in Tulsa County in addition to the 45 Oklahoma sales tax. You can find more tax rates and allowances for Tulsa County and Oklahoma in the 2022 Oklahoma Tax Tables. Wayfair Inc affect Oklahoma.

100 US Average. The current total local sales tax rate in Tulsa OK is 8517. The most populous zip code in Tulsa County Oklahoma is.

The good news is that only the state charges income tax so theres no need to worry about local taxes. Tulsa Ok 74107 located next to the west side Department of Public Safety Driver License Testing April Inhofe Owner. Oklahoma Income Tax Calculator How To Use This Calculator You can use our free Oklahoma income tax calculator to get a good estimate of what your tax liability will be come April.

Taxing units include cities county school and various special purpose districts such as sanitation treatment plants recreational parks and colleges. Taxes are based upon budgets submitted by taxing jurisdictions and include the amounts necessary to pay bonded indebtedness approved by a vote of the people. Has impacted many state nexus laws and.

Tulsa County in Oklahoma has a tax rate of 487 for 2022 this includes the Oklahoma Sales Tax Rate of 45 and Local Sales Tax Rates in Tulsa County totaling 037. Tax rates range from 025 to 475. RE trans fee on median home over 13 yrs Auto sales taxes amortized over 6 years Annual Vehicle Property Taxes on 25K Car.

The countys average effective property tax rate of 113 is above both the state average of 087 and the national average of. Sales Tax Breakdown Tulsa Details Tulsa OK is in Tulsa County. The Sooner States property taxes are also below average with an average effective rate of 087 25th-lowest in the US.

This is the total of state county and city sales tax rates. What is the lodging tax rate. It isnt all good news for Oklahoma taxpayers however.

The median property tax also known as real estate tax in Tulsa County is 134400 per year based on a median home value of 12620000 and a median effective property tax rate of 106 of property value. Oklahoma is ranked 972nd of the 3143 counties in the United States in order of the median amount of property taxes collected. Ad Compare Your 2022 Tax Bracket vs.

Discover Helpful Information and Resources on Taxes From AARP. View Larger Map. Nonresidents who purchase vehicles in Oklahoma are not assessed Oklahoma.

6009 E 117th Pl Tulsa Ok 74137 Realtor Com

Tulsa County Oklahoma Detailed Profile Houses Real Estate Cost Of Living Wages Work Agriculture Ancestries And More

2047 W 78th St Tulsa Ok 74132 Realtor Com

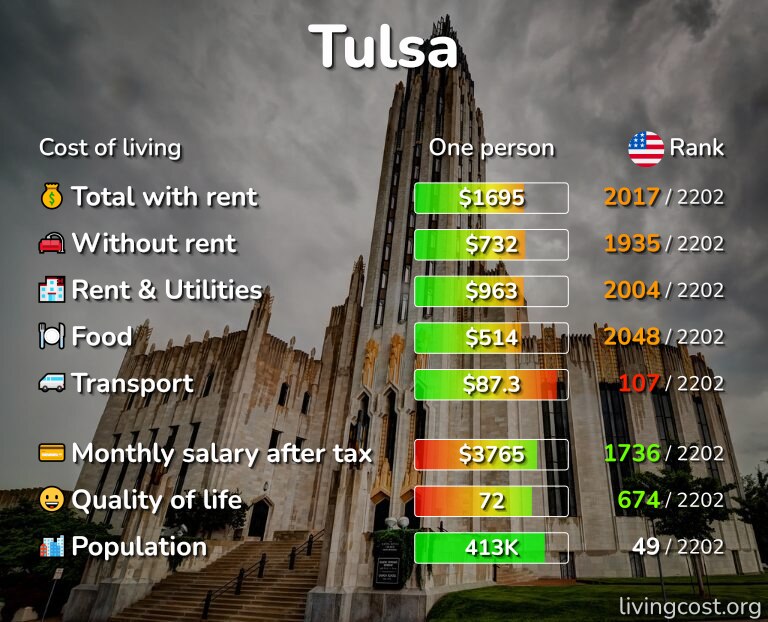

Tulsa Ok Cost Of Living Salaries Prices For Rent Food

Individual Income Tax Oklahoma Policy Institute

1544 S Columbia Pl Tulsa Ok 74104 Realtor Com

Amazon Com Tulsa Oklahoma Zip Codes 36 X 48 Paper Wall Map Office Products

The Plaza Shopping Center Price Edwards And Company

Best Assisted Living In Tulsa Ok Retirement Living

How Oklahoma Taxes Compare Oklahoma Policy Institute

The Tulsa County Oklahoma Local Sales Tax Rate Is A Minimum Of 4 867

Tulsa County Oklahoma Detailed Profile Houses Real Estate Cost Of Living Wages Work Agriculture Ancestries And More

Vintage Oklahoma Postcard Tulsa Oil Capital Of The World Etsy

Tulsa County Oklahoma Detailed Profile Houses Real Estate Cost Of Living Wages Work Agriculture Ancestries And More

2412 E 22nd St Tulsa Ok 74114 Realtor Com

Map Of Tulsa Oklahoma Area What Is Tulsa Known For Best Hotels Home

West Park Apartments 2405 E 4th Pl Tulsa Ok 74104 Realtor Com

Pros And Cons Of Living In Tulsa Ok Securcare Self Storage Blog

/https://s3.amazonaws.com/lmbucket0/media/business/4DSR_Tulsa_OK_20220726222236_Ext_01.bcc146bb832cb4c03d349dbc8e7521eaabbbe420.jpg)